I have the benefit (and sometimes curse) of having an engineering degree and a finance degree. Due to this background I tend to analyze everything. In dealing with clinics and hospitals of all sizes, I see numerous purchase decisions being made. Sometimes the purchase decision is related to direct purchase of medical equipment, and sometimes it's related to a rent rather than buy decision.

As part of the purchase decision, most individuals are making some type of return calculation to determine their medical equipment return on investment. This calculation is either explicit (done on a spreadsheet) or implicit (done in one’s head). The basic decision centers around the ability of the clinic/hospital to earn its money back after purchasing the equipment and then go on to make a profit. In finance this is typically called an internal rate of return (IRR). It is a relatively straightforward calculation that will tell you if you are making the right decision in your purchase. The higher the IRR The better the expected financial outcome. The key inputs to an IRR calculation are:

- the upfront cost,

- the recurring cost,

- the net cash flow's generated from the underlying equipment, and

- the residual value of the purchased equipment at the end of the period of time being analyzed.

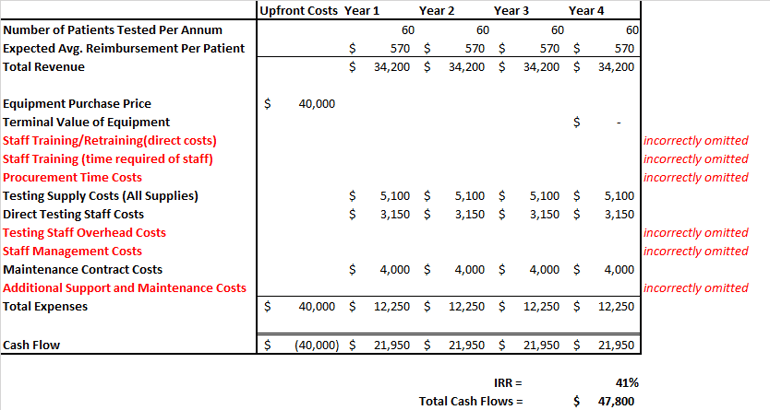

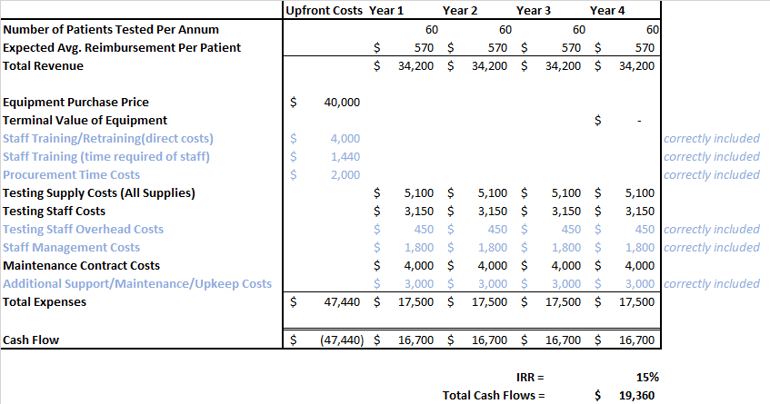

For example, let’s look at the purchase of urodynamics testing equipment and required peripherals. Your upfront equipment costs would likely be approximately $40,000. You then have recurring costs of the maintenance agreement for the equipment, the staff required to perform urodynamics testing, the supplies required for testing, and other ancillary related expenses. Your net cash flows would be your reimbursements for the urodynamics testing you perform after taking out the recurring expenses. Then, finally, you must estimate the number of years of useful life your equipment will have. Now, project this calculation forward over the number of years of use for the given purchased equipment, determining the net cash flow. Finally, you would consider the residual value of the equipment at the end of your analysis period. For most medical equipment that has been used for several years, a safe estimate is a residual value of $0. This combination of inputs leads you to the IRR. Example IRR calculations are provided in the tables below.

I often see a threefold mistake in the calculation of IRR. First, the full upfront costs are not calculated properly. Less obvious costs are often not factored in. For example, required training is often excluded. Also, larger institutions don't factor in the real costs of the paperwork required to make a capital purchase. This should be included in the cost of acquisition. I have seen some large institutions spend what I estimate to be $5,000 for paperwork and approvals for a $15,000 purchase.

Second, the recurring expenses are not calculated properly. In the example I used for urodynamics testing, organizations will often under estimate the cost required to perform this test. It's easy to forget the overhead required for a nurse as an example. Thirdly, organizations will over overestimate their utilization rates. For example, if you end up using the equipment at a rate half what you projected, it's very easy to end up with a negative internal rate of return rather than a positive internal rate of return. This last issue of utilization rate projection is often the most difficult because it requires you to project out over many years what you will be doing. This is always hard in today's healthcare world. I have seen many organizations purchase expensive equipment with the expectation of doing much with it only to lose critical staff later and have the equipment sitting there collecting dust only a year after purchase. In the finance world we would often call this "risk".

As an example, I included an IRR analysis of what I often see done in the market and what I believe should be done in the market when calculating internal rate of return.

Incorrect Medical Equipment IRR Calculation (Excludes Some “Less Obvious” Costs)

Correct Medical Equipment IRR Calculation – Includes All Relevant Costs

If you would like a spreadsheet for this please click here. As you can see in the examples above, the first paints an overly rosy picture because it excludes critical costs. The second is much more realistic. A 15% IRR is very good, but you should read further to learn how to enhance this IRR.

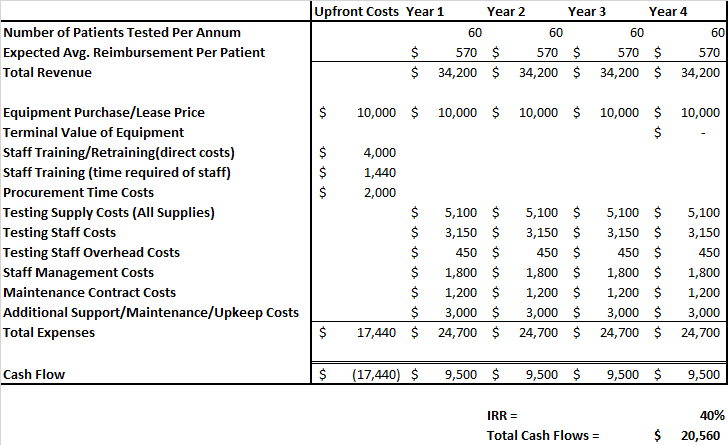

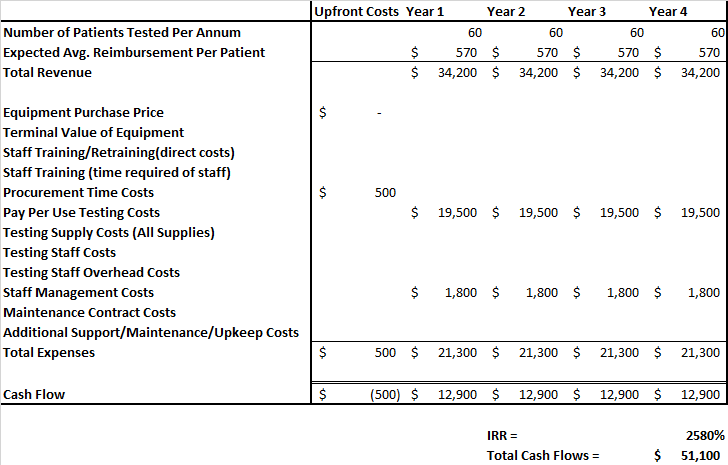

One common way by which to enhance IRR is to lower the upfront costs significantly. This can often be done by making a lease or rent decision as opposed to a capital purchase decision. An even better option is to be able to pay per use rather than rent with a flat monthly payment. You must be careful not to run afoul of the regulatory requirements here, but if you can create this scenario of pay-per-use then you can significantly improve your internal rate of return which has a big impact on your profitability. An added advantage of a pay-per-use scenario is that it offloads most of the risk to your vendor/counterparty. For example, if you make a profit on every procedure done and there's no way to lose money on a procedure and you have near zero upfront costs, then your risk is effectively nil. This is the scenario we try to create for our clients with our on-site, turn-key medical testing. IRR calculations for rent/lease and a pay-per-use are shown below.

Medical Equipment Rent/Lease IRR Calculation

Medical Equipment Pay-Per-Use IRR Calculation

(Note: The very high IRR shown above is correct. It is this high because the upfront costs are very minimal. If you generate a solid return with very little investment, you end up with a very high IRR.)

In summary, four different IRR scenarios were show above. I hope they will all get you thinking about your equipment purchase and leasing plans. At a minimum, it should help you think about structuring a robust IRR model, but it should also have you considering creating pay-per-use scenarios in order to optimize the use of your capital. If you can create pay-per-use scenarios, be sure to consult a healthcare attorney because there are a few tricky regulatory hurdles you must deal with.

Whether you agree or disagree, please provide your comments below. We would like to hear from you. If you would like to learn more about our pay-per-use urodynamics testing options, please click the button below.