Want to understand what's coming down the line for professionals who specialize in urodynamics? Don't just look to new diagnostic technologies or evolving caregiving practice standards. Urodynamics reimbursement rates are also a great bellwether of practice viability.

Medicare reimbursement rates play a huge role in the usage of urodynamics. By determining how much healthcare providers receive for the services they provide to Medicare beneficiaries, reimbursement rates define the bottom line — and where it's going — ultimately deciding the availability of treatment and testing options.

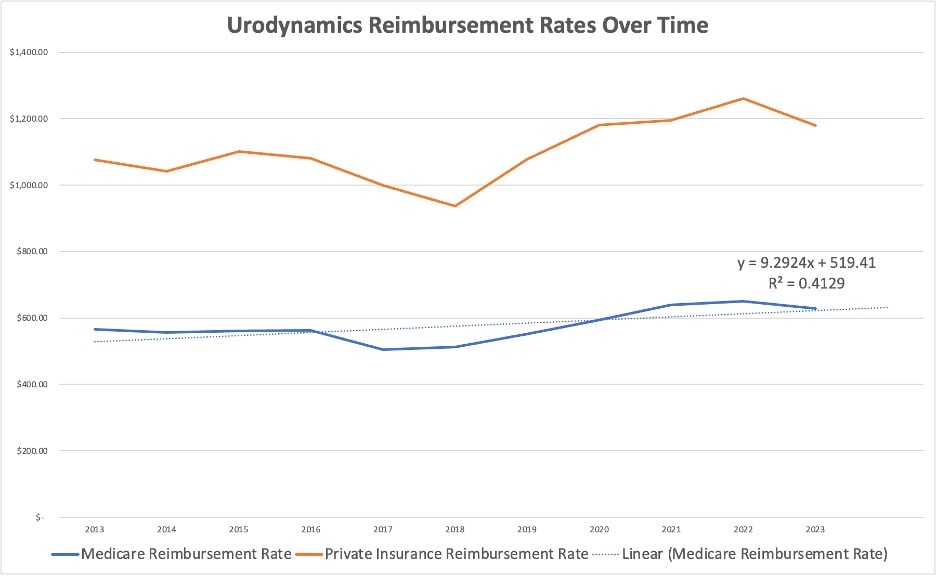

So where are reimbursements headed? Here's a look at a characteristic dataset that covers a ten-year period from 2013 to 2023.

The Data Set and Methodology

This data set's primary focus was on Medicare reimbursement rates for urodynamics testing. To gain broader insights, we also charted comparable private insurance reimbursement rates. (See Figure 1 below)

Figure 1 – Urodynamics Reimbursement Rates Over Time 2013-2023

Our quick analysis tracked Medicare and private insurance trends for four commonly billed CPT codes, including:

- 51729 Complex cystometrogram with calibrated electronic equipment with VP & UP,

- 51741 Complex uroflowmetry with calibrated electronic equipment,

- 51784 Electromyography studies (EMG) of anal or urethral sphincter, and

- 51797 Voiding pressure studies, intra-abdominal (i.e. rectal, gastric, intraperitoneal).

For all years in the assessment, we adjusted CPT codes 51741 and 51784 using modifier -51 as necessary. This modifier indicates that a physician performed at least two services during a single session, which is common with these codes.

Looking at the Numbers

The first thing that should jump out to you is that both private insurance and Medicare reimbursement rates followed similar moderate upward-leaning trends. Both data sets saw a dip from 2016 to 2017. This was also in line with our observation that code 51784 — anal/urinary muscle study — experienced a significant downward adjustment over the same period.

Things got back on target after 2017, trending upward at what appeared to be higher rates than before 2016. This culminated with another downward adjustment in the final year tracked, 2023.

A simple linear regression seemed to support the notion that there's a modest trend — at least for Medicare. Rates are going up gradually despite passing market swings. If the adjustment to the EMG CPT codes is removed, then the trends is relatively sound and upward. We don't expect to see another major CPT code adjustment as we did with he EMG code back in 2016.

One interesting thing that jumped out to us involved the distinctions between private insurance and public-sector rates. Although insurers reimbursed providers for significantly more, the amounts they paid were far more variable year over year. This makes sense — the private sector is far more exposed to market changes that impact its stability.

What Will Happen to Future Urodynamics Reimbursement Rates?

So what do these numbers mean for what's to come? While it's impossible to say what factors impacted rates using this data alone, it seems undeniable that there's a prevailing trend — one with the potential to impact both private insurance and Medicare.

The cause could be almost anything, including increased public awareness of urodynamics services and heightened demand. The Centers for Medicare & Medicaid Services (CMS) has a direct impact on how much urodynamics providers get paid — and a major influence on trends in the private sector.

Case in point: A 2023 CMS advance notice included multiple proposals for updating Medicare rules as part of the 2022 Inflation Reduction Act. As initially announced, these changes would affect everything from Medicare Advantage (MA) effective growth rate calculations to risk adjustment methodologies. Considering that CMS believes the new plan will result in a 1.03 percent rise in MA payments, it wouldn't be surprising if private insurers also felt pressure to keep up.

While it's promising that CMS wants to reassess reimbursement rates to incorporate current inflation data, providers probably shouldn't get too comfortable. In December, Congressional lawmakers revealed finalized cuts to Medicare Physician Fee Schedule payments, slashing some 5.5 percent between 2023 and 2024. This itself reflects an ongoing trend — of lawmakers announcing big cuts and then negotiating them down after protests from caregivers.

So what's the lesson? If you're a provider, just realize that different parts of the government aren't really on the same page. One hand (Congress) doesn't seem to know what the other (CMS) is doing or thinks best. This is only natural in a "free" market, but it can definitely put you on edge: Even if future rates are likely to keep trending upward, inflation, labor costs, and other business expenses will also follow suit.

Urodynamics providers need to consider the whole picture. Reimbursement rates seem to be stable as compared to decades past. However, costs are rising. The cost of labor is rising, and the costs of urodynamics supplies is rising drastically (urodynamics supply costs has risen more 50% in the last few years). This can crimp profit margins.

Want more pointers on building a market-proof practice? Check out these blog posts on rethinking your cost structure and expanding your referral networks. Or discover more expanding your urodynamics testing capabilities by reaching out to a Brighter Health Network specialist.